Whether you're entering the job market for the first time or considering switching careers, it's important to think about the entry-level positions that will be available to you. The first thing to consider is where the jobs are going to be when you're ready to enter the field. A great place to start is to look at the top growing industries. This will ensure that you are entering a field that will be a viable place to work in the future. Two industries to consider are healthcare and information technology. They are among the fastest growing industries today and have opportunities for a variety of levels of education. The US Department of Labor is estimating that the field of IT will grow by thirty percent, and the healthcare field will see the addition of 3.2 million jobs by 2018. However, these massively expanding industries are not the only places promising entry-level work. According to the National Association of Colleges and Employers, accounting majors are currently receiving the most job offers with starting salaries around fifty thousand. Other highly employable majors include sales and investment banking. The best news of all is that the average salary offer for entry-level employees is on the rise. So whether you're proactively deciding on a stable future or looking into a new career path, there are plenty of options available to make sure you're hired in no time. For thousands of how-to and advice videos on any topic, visit monkey-see.com.

Award-winning PDF software

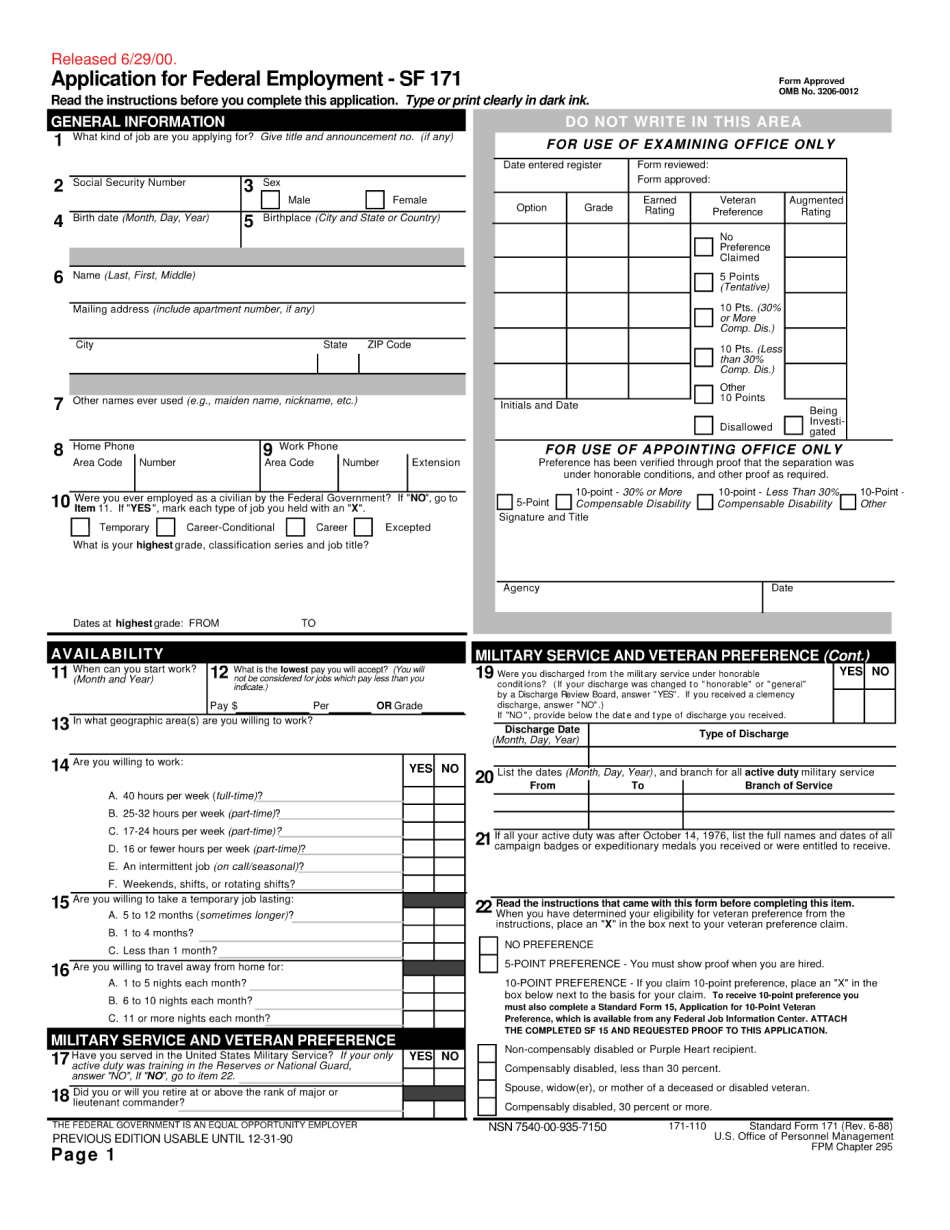

Entry level government jobs Form: What You Should Know

Once we have your application complete, we review it to be sure you have met the qualifications and require that you submit a background check, fingerprinting and an interview at one of the federal agencies or by the U.S. Census Bureau. In the meantime, we will email you with information about your next steps to submit your application. You may also call the help center or go to for details on your next steps to begin processing your application. JOBS Help Center To keep up with the latest job postings for the federal government, go to : This site is not updated daily, so please check regularly. There are hundreds of job opportunities in California.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 171, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 171 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 171 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 171 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Entry level government jobs